Discover more from Investing On Substack

How Caleb Franzen went from unknown analyst to trusted source

The writer behind Cubic Analytics shares growth moments in this week’s takeover

We invited Caleb Franzen, who writes Cubic Analytics full-time, alongside managing his own portfolio and portfolios of clients, to share meaningful moments working with influencers in the space to grow his Substack.

What questions do you have for Caleb? Leave them in the comments and we’ll ask him live at this week’s Investing Happy Hour on Twitter Spaces.

Publication at a glance

About: Analyzing key data on the economy, the stock market, and Bitcoin

Started on Substack and launched paid subscriptions: May 2021

Free subscribers: 2,000

Paid subscribers: 150

Schedule: Twice weekly, one free and one paid

Post types: Original analysis of monetary policy, macroeconomic data, stock market dynamics, and Bitcoin developments

Meaningful growth moments

Getting started. I quit my corporate banking job as a portfolio analyst in September 2020, deciding to publish my investment research online. I started sharing macro and investment research on Twitter. Encouraged to start a newsletter by former colleagues and friends, I launched Cubic Analytics in May 2021. As a relatively unknown analyst, I started with roughly 25 Substack subscribers and 600 Twitter followers.

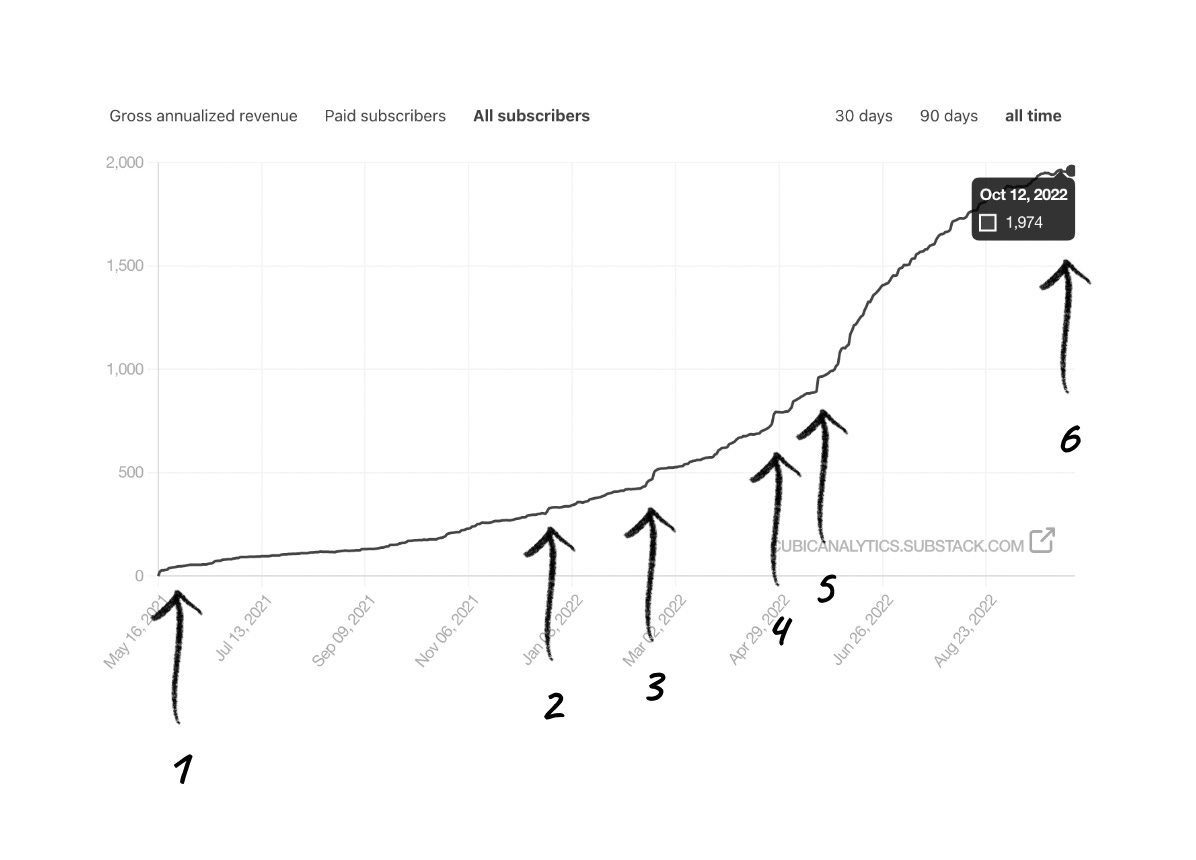

Growth on Substack mirroring Twitter. Growth on Substack was steady but strong, often mirroring my growth on Twitter. The graph above looks linear for 2021, but it seemed exponential at the time.

For about the first three months of publishing, I was posting daily: new market research Monday through Friday and paid editions on the weekend. By January 2022, I switched to weekly free newsletters every Saturday and premium editions on Sunday. This decreased pace was by design, intended to increase my library of free, relevant research available for industry professionals. I defined paid subscriptions at this moment, offering a weekly deep dive on market conditions and exclusive research, studies, and data.Read more: Make your best work free

Original reporting. In December 2021, I had around 2,000 Twitter followers and 280 total Substack subscribers. During the month, I shared never-before-seen Bitcoin analysis on Twitter, which got on the radar of Anthony Pompliano. He dedicated an entire issue of The Pomp Letter to discussing the findings of my analysis, citing my links and profile. This boosted traffic tremendously and catalyzed a new phase of my growth, using his platform as a megaphone for my research. For writers in the world of finance and economics, it’s important to find an original voice and shine a light on analysis that no one else is doing. This will help you find the right people who will want to spread your work even further.

Topic aligned with hot trends. With macroeconomics dominating the market narrative in 2022, investors seemed to have a high demand for long-form content focused on monetary policy and macroeconomics. These topics are core components of my research, so this naturally created tailwinds for growth, particularly at the end of Q1 2022. Analysts and creators who had a larger audience than myself resonated with my professional experience and market commentary, so any retweets and engagement from them helped to spur more growth on Substack.

Collaborating with influencers. After connecting with Pomp in December 2021, he reached out to me in June 2022 to write a guest post for his newsletter, The Pomp Letter, sharing my views on the economy and the market environment. I was also invited onto his podcast two times over a six-week period. June was my most successful month in terms of total subscriber growth, paid subscriber growth, and total revenue.

Looking ahead. I’ll continue to invest the majority of my time by sharing valuable insights and analysis with subscribers, both free and paid. I have zero background in marketing or social media growth, so I continue to take a trial-and-error approach that allows me to experiment with new growth and outreach strategies. Networking and referrals are at the top of mind for me, particularly after witnessing the growth after larger analysts and creators shared my work. I recently started going on podcasts and livestreams to share my ideas and promote my work, which has been extremely rewarding and helpful in fostering growth.

With nearly 2,000 total subscribers and roughly 150 paid subscribers, my goal is to converge on a 10% conversion rate of paid/total subscribers. One of my primary goals throughout this journey has been consistency. Since launching in mid-May, my monthly compounded growth rate for total subscribers is +35% per month. While I certainly expect this to decelerate over time, which it already has, I’m trying to find new ways to drive growth going forward in order to increase the amount of value I’m providing at Cubic Analytics.Read more: The making of a successful collaboration

What questions do you have for Caleb? Leave them in the comments and we’ll ask Caleb live at this week’s Investing Happy Hour on Twitter Spaces.

Join us for Investing Happy Hour with Caleb on Wednesday at 5 p.m. ET.

Very interesting post, thanks for sharing it!

Especially like this bit: “The graph above looks linear for 2021, but it seemed exponential at the time.” Whenever I look at my subscribers I feel the same 😂

Good post, though the graphic at the top shows 7k subs, but the substack growth chart shows about 2k all subs